How do I submit my Social Insurance Number (SIN) to get a tax receipt?

As of the 2019 tax year the Canada Revenue Agency (CRA) requires your Social Insurance Number (SIN) be included on the tax receipt document. The Income Tax Act (ITA) requires us to make reasonable efforts to obtain the SIN. If you have general questions about tax receipts, please see our support article: Tax receipt or T2202/T2202A Tuition and Enrolment Certificate Frequently Asked Questions

You will only need to submit your social insurance number once. It will be securely stored and protected with advanced encryption and only used to generate tax receipts (T2202 tuition and enrollment certificates) for each tax year you took a course with us.

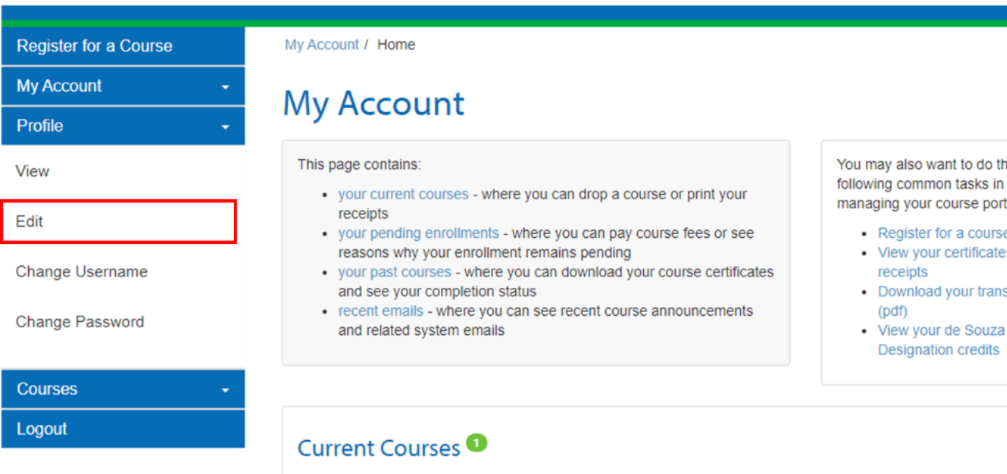

You can enter your SIN by logging into My Account. From your My Account home screen, select Profile from the menu on the right and click Edit. The direct link to edit your profile is: myAccount -> View -> Edit

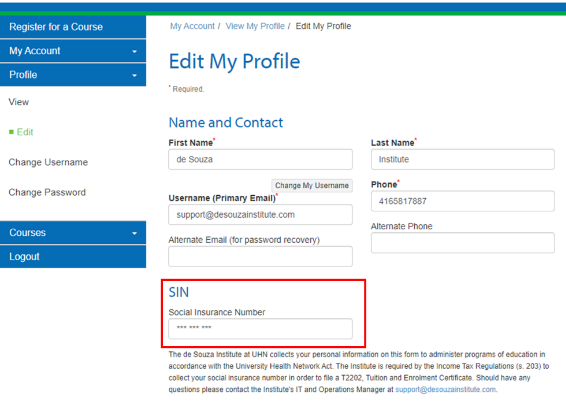

On the "Edit My Profile" page, scroll down to the SIN section and enter your nine-digit SIN in the indicated field without any spaces or hyphens. Scroll to the bottom of the page and click Submit to save the changes to your profile.

Once successfully saved you will get a message that says "Successfully edited your profile."

If you go to the Edit My Profile page again, the Social Insurance Number will appear masked to protect privacy, as shown below:

Share